Do you know that after 31st December 2019 your PAN card will lose it value and will be of no use in the government’s eyesight? Thus, to avail the benefits of your PAN card deliberately you should Link your PAN card with your Aadhaar Card before the 31st December 2019 and if you fail to Link Pan with Aadhaar so your PAN card will be of no use.

Table of Contents

Linking Aadhaar Card With PAN Card

Your Aadhar card will be linked with your PAN card and also with all the other relevant documents such as driving licence etc. But you just have to keep in mind the last date to link Aadhaar with your PAN card that is 30th September 2019 (Now Extended 31st December 2019 ). Thus, you have to carry on the process before the given date. This date has been finalized by the concerned authorities and this step has been implemented for the citizens to confirm the identities and stop the fraudulent practices.st

Aim Through Link Pan with Aadhaar

The main aim and motive through the linking of PAN card with your Aadhar card is to prevent the fraudulent practices that have been implanted in our society. As we know that many of the citizens have been making duplicate PAN card and Aadhar card to avail the benefits of the various schemes that have been implemented by the government in our country indirectly. Many rich people have been snatching the schemes meant for old and poor people. So, to stop this fraudulent practices the linking of documents have been initiated by the government.

Ways To Link PAN With Aadhaar

There are many ways through which the individuals can link their PAN card with their Aadhar card.

Through Income Tax E-filing Website

If you are an already registered user – If you are actively filing your income taxes through E filing website then, chances are that your Aadhar card has already been linked to your PAN card if you have mentioned your Aadhar card number anywhere while filing the tax through the online portal. You can check this by visiting the official website Official Website

But, if your Aadhar card is not yet linked with your PAN card then follow simple steps to link it:-

- First, visit the official website

- After login, go to your profile and click on the profile settings.

- Select the Link Aadhaar option.

- A form will be displayed on the screen.

- Fill in the required details such as Name, Date of Birth and Gender as per PAN records.

- Next submit your Aadhaar number.

- Click on submit after entering the captcha code.

- Thus, a success message will be displayed on your screen.

If you are not already registered user – If you have not registered yourself under the Income Tax e-filing website.

you can link your Aadhaar Card with your PAN card through these following steps:-

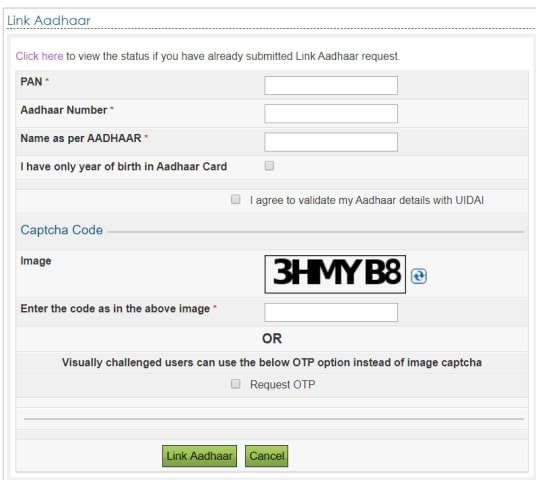

- First visit the official website.

- Click on the tab present at the home screen called link Aadhaar

- Therefore an application form will be displayed to you

- Fill in all the required details such as Name, PAN card number, and Aadhar card number, etc.

- Enter the captcha code

- Click on submit

- Thus, a success message will be displayed on your screen.

Through SMS Service Link Pan with Aadhaar

- If you are unable to link your Aadhaar through the Income Tax e-filing portal then you can also do that through the sms service on your mobile phones.

- As we know that the issuing of PAN card is the responsibility of NSDL or the UTI.

- Thus, you can SMS either of the two that is NSDL e-Governance Infrastructure Limited or UTI Infrastructure Technology and Services Limited (UTIITSL)

Send your respective Aadhar Card and PAN card Unique Identification number in the format given UIDPAN SPACE 12 digit Aadhaar SPACE 10 digit PAN to either 567678 or 56161

Note – SMS charges may be applicable.

Through Service Centres

- Apart from all the services mentioned above the PAN card can be linked to Aadhar Card via service centres made mandatory by the government.

- The service centres will be initiated from NSDL and UTI to carry out the linking project.

- Also, the service centre can carry out the process of anything important related to PAN card and Aadhar card.

- You will be required to fill in the form called ‘Annexure-I’

- Also, you are supposed to take a copy of all the documents that is needed to link the PAN card with Aadhaar card you must also bring along a Copy of PAN card and Aadhar card.

- Although, the service centres will charge a fixed amount of fees for linking your PAN card with your Aadhar Card. In case, you want to give a correction in your PAN card the fees is Rupees 110 and In case you want a correction in Aadhar Card the fees is Rupees 25.